尋夢新聞LINE@每日推播熱門推薦文章,趣聞不漏接❤️

央行今日無逆回購操作,逆回購到期1200億,今日繼續大幅淨回籠資金1200億。資金面維持非常寬鬆,月末財政資金投放,隔夜早盤價格進一步下行,加權價格下行至1.5左右,7天價格2.6左右供給較為充分,尾盤隔夜一度轉緊,需求增多,隔夜價格一度回升至2以上,但並未持續,今日回購市場成交維持在3萬億左右。

DR001

1.5398

1.8206

-28.08

DR007

2.5295

2.603

-7.35

DR014

2.4763

2.6894

-21.31

DR021

2.65

2.6513

-0.13

利率

18國開11,期限5Y,規模80,中標收益3.7049

18國開12,期限3Y,規模70,中標收益3.3907

18國開10,期限10Y,規模100,中標收益4.0208

18國開14,期限7Y,規模60,中標收益4.0308

18兵團債01,期限5Y,規模16,中標收益3.75

18兵團債02,期限10Y,規模24,中標收益3.94

18兵團債03,期限20Y,規模20,中標收益4.25

18安徽17,期限5Y,規模17.8,中標收益3.75

18安徽18,期限5Y,規模6.6,中標收益3.75

18廣西債20,期限10Y,規模6.3,中標收益3.94

CP

18南新工SCP005, 0.74年休1, 10億, 主體AAA, 國企, 【票面利率3.7%】

18恒信租賃CP002, 1.00年, 10億, 主體AAA, 國企, 【票面利率4.3%】

18常高新SCP005, 0.49年, 6億, 主體AA+, 國企, 【票面利率4.0%】

18建安投資SCP002, 0.74年休2, 10億, 主體AA+, 國企, 【票面利率4.35%】

18北部灣投SCP004, 0.74年休1, 8億, 主體AA+, 國企, 【票面利率4.33%】,

18蘭州城投CP002, 1.00年, 10億, 主體AA+, 國企, 【票面利率4.18%】

18銅陵建投CP003, 1.00年, 10億, 主體AA, 國企, 【票面利率4.85%】

18九江置地CP001, 1.00年, 4億, 主體AA, 國企, 【票面利率4.85%】

18魯高速股SCP002,15e,180D,AAA,地方國企,【票面利率3.50%】

18浙交投SCP002,20e,270D, AAA,地方國企,【票面利率3.50%】

18閩建工SCP002,5e,270D,AA,地方國企,【票面利率4.69%】

18大同煤礦CP006,25e,365D,AAA,地方國企,【票面利率4.67%】

18泰豪科技SCP001,5e,270D,AA,公眾企業,【取消發行】

18西南水泥SCP007,10e,270D,AAA,央企,【取消發行】

18泰豪科技CP001,5e,365D,AA,公眾企業,【取消發行】

18酒鋼SCP002,5e,270D,AA+,地方國企,【取消發行】

MTN

18中交房地產MTN001, 3.00年休1, 10億, 主體AAA,【票面利率4.56%】

18凌雲工業MTN001, 3.00年休1, 7億, 主體AA+, 央企, 【票面利率4.5%】

18中國航材MTN001, 5.00年, 6億, 主體AAA, 國企, 【票面利率4.42%】

18兗礦MTN012, 3+N年休2, 15億, 主體AAA, 國企, 【票面利率5.78%】

18徐礦MTN001, 3.00年休2, 10億, 主體AA+, 國企, 【票面利率5.53%】,

18農四師MTN001, 3.00年休1, 5億, 主體AA+, 國企, 【票面利率5.19%】

18宜春城投MTN001, 3+2年, 5億, 主體AA, 國企, 【票面利率5.28%】

18大同煤礦MTN008,10e,3,AAA,地方國企,【票面利率6.19%】

企業債

1、18餘旅遊, 6億, 7年, AA/AAA, 中國中投證券, 杭州餘杭城市建設集團有限公司, 5.57%

2、18漳州城投債, 7.3億, 7年, AA+/AA+, 國開證券, 無, 5.73%

周三簿記企業債

無

1、(高宇)國債方面,國債現券交投活躍,昨夜美債收益率繼續走高走陡,早盤股市表現回暖,午盤自己面略有收緊,現券收益率整體震蕩上行。國債期貨高開低走,午後反彈走出V型,合約T1812收跌0.05%,收在95.750,TF1812收跌0.02%,收在98.350,TS1812收漲0.01%,收在99.610。現券方面180019上1.75bp,收在3.525,180016下1.5bp,收在3.32。

1y (0bp) 2.29

3y (-1bp) 3.15

5y (-1.5bp) 3.32

7y (0bp) 3.5

10y (1.75bp) 3.525

30y (-0.5bp) 4.055

10y 180019 gvn 3.51,3.5075,3.515,3.525 上1.75bp

2、(高宇)金債方面,現券交投活躍,現券收益率震蕩上行;現券方面,180205收盤上1.25bp,收在4.1725,180210收盤上1.5bp,收在4.0775。以下是具體成交:

1y國開 (1bp) 2.7

1y非國開 (0bp) 2.73

3y國開 (-0.5bp) 3.49

3y非國開 (0.25bp) 3.4925

5y國開 (0.5bp) 3.79

5y非國開 (-1.5bp) 3.805

7y國開 (-1.5bp) 4.085

7y非國開 (-1bp) 4.08

10y國開 (1.25bp) 4.1725

10y非國開 (1bp) 4.195

20y國開 (-5bp) 4.34

5y 180211 trd 3.785,3.76,3.78,3.79 上0.5bp

10y 180205 trd 4.155,4.145,4.16,4.1725 上1.25bp

10y 180210 gvn 4.05,4.045,4.06,4.0775 上1.5bp

3、(朱琳)今日短融市場交投活躍度一般,基本是AAA成交,半年以上成交者明顯增多,年內到期收益率無太大變化,3-6M在3.3-3.6不等,估值小幅減點,長端成交以優質過硬AAA為主,匯金、電網等,收益率在3.5上下,較上周有所下行。

20D 18國聯SCP003 AAA/0 2.8 (-2.7 bp)

21D 18錫產業SCP008 AAA/0 2.85 (2.5 bp)

23D 18中電投SCP035 AAA/0 2.55 (255 bp)

23D 18雲城投SCP002 AAA/0 4.28 (9.4 bp)

23D 18中車SCP001 AAA/0 2.6 (1 bp)

25D 18河鋼集SCP004 AAA/0 2.95 (11.4 bp)

26D 18南航集SCP004 AAA/0 2.65 (5.1 bp)

31D 18華電SCP010 AAA/0 2.5 (-11.8 bp)

31D 18首創SCP002 AAA/0 2.82 (-0.3 bp)

35D 18魯鋼鐵SCP005 AAA/0 3.3 (-39.3 bp)

38D 18南方水泥SCP002 AAA/0 2.82 (-6.2 bp)

39D 18晉煤SCP005 AAA/0 2.93 (-27.5 bp)

46D 17重汽CP001 AAA/A-1 2.85 (-5.1 bp)

51D 18南新工SCP003 AAA/0 2.96 (-5.2 bp)

54D 18雲能投SCP007 AAA/0 3.47 (-1.2 bp)

57D 18上實SCP002 AAA/0 2.7 (-20.5 bp)

57D 18京國資SCP003 AAA/0 3 (-11.1 bp)

73D 18京城建SCP002 AAA/0 3.33 (-5.5 bp)

82D 18亦莊控股SCP002 AAA/0 3.45 (-1.7 bp)

124D 18陜煤化SCP009 AAA/0 3.5 (-9.3 bp)

127D 18海淀國資CP001 AAA/A-1 3.54 (-0.4 bp)

128D 18陜高速CP001 AAA/A-1 3.72 (7.5 bp)

128D 18鞍鋼集CP001 AAA/A-1 3.91 (-10.9 bp)

135D 18格力SCP006 AAA/0 3.5 (-8.7 bp)

143D 18中鋁集SCP009 AAA/0 3.5 (-11.4 bp)

145D 18南電SCP007 AAA/0 3.29 (0 bp)

145D 18兗州煤業SCP004 AAA/0 3.71 (-0.6 bp)

147D 18大同煤礦CP001 AAA/A-1 4.33 (-10.7 bp)

161D 18文廣集團SCP002 AAA/0 3.6 (-2.3 bp)

170D 18洋河SCP003 AAA/0 3.64 (1.5 bp)

171D 18寧滬高SCP006 AAA/0 3.45 (-5.5 bp)

171D 18寧滬高SCP006 AAA/0 3.5 (-0.5 bp)

175D 18成都高新CP001 AAA/A-1 3.8 (-7.4 bp)

176D 18光明SCP007 AAA/0 3.35 (-3.6 bp)

189D 18中航資本SCP002 AAA/0 3.62 (-1.4 bp)

212D 18東航股SCP009 AAA/0 3.52 (-4 bp)

227D 18陸家嘴SCP002 AAA/0 3.55 (-8.1 bp)

248D 18電網CP001 AAA/A-1 3.45 (0 bp)

248D 18電網CP001 AAA/A-1 3.45 (0 bp)

259D 18光大集團SCP002 AAA/0 3.59 (1.4 bp)

262D 18南方水泥SCP008 AAA/0 3.8 (-2.2 bp)

262D 18南電SCP012 AAA/0 3.51 (1.9 bp)

262D 18南電SCP012 AAA/0 3.51 (1.9 bp)

262D 18南方水泥SCP008 AAA/0 3.8 (-2.2 bp)

265D 18華電股SCP004 AAA/0 3.55 (-3.8 bp)

266D 18廣州金融SCP003 AAA/0 3.65 (-11 bp)

269D 18南航股SCP004 AAA/0 3.6

270D 18皖投集CP002 AAA/A-1 3.8 (3.1 bp)

294D 18電網CP002 AAA/A-1 3.5 (-5.5 bp)

294D 18電網CP002 AAA/A-1 3.49 (-6.5 bp)

297D 18匯金CP005 AAA/A-1 3.53 (-2.9 bp)

301D 18電網CP003 AAA/A-1 3.48 (-8.3 bp)

322D 18鞍鋼CP004 AAA/A-1 3.86 (-0.6 bp)

333D 18國家核電CP001 AAA/A-1 3.7 (-4.8 bp)

347D 18匯金CP006 AAA/A-1 3.59 (0.5 bp)

347D 18匯金CP006 AAA/A-1 3.58 (-0.5 bp)

20D 18杭州灣SCP001 AA+/0 3.12 (0.2 bp)

22D 18大唐租賃SCP002 AA+/0 3.24 (-0.8 bp)

23D 18南京新港SCP003 AA+/0 3.1 (-10.3 bp)

40D 18太湖新城SCP001 AA+/0 3.55 (3.1 bp)

40D 18新中泰集SCP002 AA+/0 4.3 (9.3 bp)

40D 18渝化醫SCP002 AA+/0 6.4 (32.3 bp)

56D 18雲工投SCP001 AA+/0 4.4 (-14.3 bp)

83D 18鎮國投SCP006 AA+/0 8.7 (200.2 bp)

88D 18晉江城投CP001 AA+/A-1 3.87 (6 bp)

90D 18宿遷水務SCP002 AA+/0 4.4 (2.9 bp)

121D 18九州通CP001 AA+/A-1 5 (-0.8 bp)

123D 18恒逸SCP003 AA+/0 6.9 (-3.1 bp)

132D 18華電租賃SCP001 AA+/0 4 (-2.4 bp)

133D 18天業SCP002 AA+/0 4.5 (-12.5 bp)

137D 18南京新港SCP004 AA+/0 3.97 (-3.8 bp)

145D 18昆山國創SCP004 AA+/0 4.54 (-5.7 bp)

145D 18太湖新城SCP002 AA+/0 4.13 (-2.7 bp)

146D 18南京新港SCP005 AA+/0 3.97 (-4.6 bp)

194D 18太湖新城SCP003 AA+/0 4.19 (0 bp)

209D 18京住總SCP001 AA+/0 3.98 (-2.3 bp)

251D 18蘇國泰SCP002 AA+/0 4.66 (0.1 bp)

277D 18柳州城投CP001 AA+/A-1 4.62 (-3.5 bp)

130D 18平頂發展SCP002 AA/0 5.25 (-13.2 bp)

4、(朱琳)今日中票市場交投活躍,以3Y內AAA為主且4Y+有少量成交,1Y期AAA在3.7-3.8之間平估值成交,2-3Y期AAA優質AAA依舊在4.0-4.1之間較多,租賃、過剩、地產依舊為收益率較高的群體,整體看估值微幅減點成交,多在5bp以內,4Y以上的成交雖不多但情緒不錯,收益率繼續下探,如中建下行至4.30。

180D(休4) 16國電集MTN001 AAA/AAA 3.5 (11.2 bp)

193D(休2) 16中建材MTN001 AAA/AAA 3.67 (3.1 bp)

198D 14北排水MTN001 AAA/AAA 3.5 (-10.5 bp)

202D 14京技投MTN001 AAA/AAA 3.68 (-2.8 bp)

263D(休2) 16東航股MTN003 AAA/AAA 3.64 (-6.4 bp)

296D 17冀中能源MTN003 AAA/AAA 5.23 (0.3 bp)

335D 14建材集MTN001 AAA/AAA 3.74 (-0.8 bp)

350d 14中聯MTN001 AAA/AAA 4.34 (0 bp)

352D 16海運集裝MTN003 AAA/AAA 4.6 (-2 bp)

363D 14中航航電MTN001 AAA/AAA 3.75 (-0.1 bp)

1.06Y 16廈門航空MTN003 AAA/AAA 3.75 (-0.6 bp)

1.08Y 14中電建設MTN001 AAA/AAA 3.66 (2.2 bp)

1.14Y 12蘇城投MTN1 AAA/AAA 3.84 (-3.4 bp)

1.17Y+NY 16首開MTN001 AAA/AAA 4.56 (8 bp)

1.24Y 15五礦股MTN001 AAA/AAA 4 (-0.3 bp)

1.25Y 15金融街MTN001 AAA/AAA 3.78 (-0.4 bp)

1.26Y 15陜延油MTN001 AAA/AAA 3.77 (-1.7 bp)

1.35Y 13誠通MTN1 AAA/AAA 3.95 (2.3 bp)

0.37Y+1Y 17兗礦MTN002 AAA/AAA 3.75 行權 (-33.1 bp)

1.39Y 17華僑城MTN002 AAA/AAA 3.8 (-1.7 bp)

1.48Y 17皖投集MTN001 AAA/AAA 3.93 (-1.2 bp)

1.62Y 17蘇沙鋼MTN003 AAA/AAA 4.63 (-2.2 bp)

1.68Y 17兗礦MTN003 AAA/AAA 4.13 (-3.5 bp)

1.71Y 15五礦股MTN002 AAA/AAA 4.05 (-7.2 bp)

1.73Y 18湘高速MTN001 AAA/AAA 3.95 (-3.5 bp)

1.74Y 17鞍鋼集MTN001 AAA/AAA 4.52 (-9.3 bp)

1.85Y 17遠東租賃MTN001 AAA/AAA 4.345 (0.5 bp)

1.87Y 17揚子國資MTN001 AAA/AAA 4.05 (4.1 bp)

1.89Y 15錫建發MTN001 AAA/AAA 4.07 (-4.2 bp)

1.97y 17誠通控股MTN003 AAA/AAA 4.25 (16 bp)

1.97y 17中化工MTN002 AAA/AAA 4.08 (-1 bp)

2.00Y 15北控集MTN001 AAA/AAA 3.88 (-5.2 bp)

2.16Y+NY 17中建三局MTN001 AAA/AAA 5.25 (-7.7 bp)

2.27Y 18河鋼集MTN001 AAA/AAA 4.14 (-0.9 bp)

2.35Y+N 16重慶地產MTN001 AAA/AAA 5.4 (25.8 bp)

2.36Y 16皖交通MTN001A AAA/AAA 3.98 (-1 bp)

2.37Y 18兗礦MTN003 AAA/AAA 4.28 (-3.4 bp)

2.38Y 18國電集MTN001 AAA/AAA 3.9 (-1.5 bp)

2.48Y 18錫產業MTN003 AAA/AAA 4.15 (-3 bp)

2.49Y 18中金集MTN001BC AAA/AAA 4.02 (-4.2 bp)

2.49Y 16大連萬達MTN002 AAA/AAA 6.18 (10.6 bp)

2.53Y 14浦發集MTN001 AAA/AAA 4 (-1.2 bp)

2.57Y 18環球租賃MTN001 AAA/AAA 4.8 (-2.9 bp)

2.58Y+NY 18中建五局MTN001 AAA/AAA 5.28 (-20 bp)

2.58Y 16重慶交投MTN001 AAA/AAA 4.1 (-2.3 bp)

2.59Y+NY 18中建八局MTN001 AAA/AAA 5.25 (-8 bp)

2.71Y 16廣州交投MTN001 AAA/AAA 4.1 (-4 bp)

2.76Y 18陜有色MTN001 AAA/AAA 4.65 (-19 bp)

2.76Y 16華虹MTN002 AAA/AAA 4.78 (-6 bp)

2.8Y 18南京交建MTN001 AAA/AAA 4.07 (-8.2 bp)

2.80Y 16金地MTN003 AAA/AAA 4.5 (-2.3 bp)

2.84Y 18海淀國資MTN001 AAA/AAA 4 (-4.8 bp)

2.95Y 18匯金MTN013 AAA/AAA 3.93 (-2.7 bp)

2.97Y 18廣核電力MTN004 AAA/AAA 4 (-0.7 bp)

2.97Y 18廣核電力MTN004 AAA/AAA 3.98 (-2.7 bp)

2.99Y 16興城投資MTN001 AAA/AAA 4.22 (-0.9 bp)

3.69Y 17餘杭城建MTN001 AAA/AAA 4.39 (-2.1 bp)

3.83Y 12華能集MTN1 AAA/AAA 4.1 (0.2 bp)

3.87Y 17誠通控股MTN001 AAA/AAA 4.38 (-9.9 bp)

3.88Y 17河鋼集MTN014 AAA/AAA 4.45 (-3.1 bp)

3.97Y 17河鋼集MTN015 AAA/AAA 4.45 (-5.7 bp)

2.39Y+2Y 18首開MTN001 AAA/AAA 4.07 行權 (-46.1 bp)

4.41Y 13甘公投MTN1 AAA/AAA 4.38 (2.3 bp)

4.45Y 18南電MTN001 AAA/AAA 4.1 (-0.8 bp)

4.48y 18贛國資MTN002 AAA/AAA 5.05 (-5.7 bp)

2.57Y+2Y 18北控水務MTN001A AAA/AAA 4.02 行權 (-28 bp)

2.72Y+2Y 18北控水務MTN002A AAA/AAA 4.03 行權 (-29.5 bp)

4.76Y 18大連港MTN001 AAA/AAA 4.78 (-6.5 bp)

4.8Y 18中建MTN001 AAA/AAA 4.3 (-5.3 bp)

4.8Y 18中建MTN002 AAA/AAA 4.3 (-5.3 bp)

4.8Y 18首創集MTN001 AAA/AAA 4.32 (-1.8 bp)

4.82Y 18魯能源MTN001 AAA/AAA 4.85 (-15.3 bp)

4.97Y 18京汽集MTN002 AAA/AAA 4.35 (-4.5 bp)

2.98Y+2Y 18皖鐵基金MTN001 AAA/AAA 4.6 行權 (-71.8 bp)

2.99Y+2Y 18國電MTN003 AAA/AAA 4 行權 (-28.8 bp)

5Y 18京國資MTN004 AAA/AAA 4.29

2.99Y+5Y 16西安高新MTN002 AAA/AAA 4.28 行權

205D 14常熟經營MTN001 AA+/AA+ 4 (-10 bp)

1.03Y 16龍盛MTN001 AA+/AA+ 4.61 (-3.3 bp)

1.35Y 17百業源MTN001 AA+/AA+ 5.2 (-17.7 bp)

1.71Y 17百業源MTN002 AA+/AA+ 5.35 (-19.8 bp)

1.82Y 17百業源MTN003 AA+/AA+ 5.4 (-19.8 bp)

1.91y+ny 17瘦西湖MTN001 AA+/AA+ 6.07 永續 (72.3 bp)

2.39Y 16江東控股MTN001 AA+/AA+ 4.89 (-7.7 bp)

2.60Y 16新長寧MTN002 AA+/AA+ 4.25 (-2.6 bp)

1.7Y+1Y 18淮安開發MTN005 AA+/AA+ 6.37 行權 (-16.6 bp)

1.7Y+1Y 18淮安開發MTN005 AA+/AA+ 6.36 行權 (-17.6 bp)

2.77Y 18新建元MTN001 AA+/AA+ 5 (-4 bp)(大量成交)

0.85Y+2Y 16光明地產MTN002 AA+/AAA 4 行權 (-38 bp)

2.98Y 18徐礦MTN002 AA+/AA+ 5.55 (-0.9 bp)

1.02Y+2Y 14吉高速MTN001 AA+/AA+ 4.63 行權 (-35.4 bp)

3.1Y+NY 16珠海華發MTN002 AA+/AA+ 5.7 (65.3 bp)

3.92Y 17華發實業MTN003 AA+/AA+ 4.9 (-4.1 bp)

4.83Y 18南昌城投MTN001 AA+/AA+ 4.7 (-8.7 bp)

4.84Y 18溫公用MTN001 AA+/AA+ 5.21 (-5.5 bp)

2.85Y+2Y 18濰坊濱投MTN003 AA+/AA+ 5.89 行權 (-78.2 bp)

174D 16新餘城建MTN001 AA/AA 4.51 (-0.4 bp)

233D 16廣州工業MTN001 AA/AA 4.2 (-7.5 bp)

295D 14祁連山MTN001 AA/AA 4.6 (-12.7 bp)

355D(休1) 16一心堂MTN002 AA/AA 5.05 (-9 bp)

1.59Y 17邯交建MTN001 AA/AA 4.8 (1 bp)

1.69Y 15安慶城投MTN001 AA/AA 4.46 (-0.2 bp)

0.13Y+2Y 15置地投資MTN001 AA/AA 4.18 行權 (21.7 bp)

2.39y 18新田投資MTN001 AA/AA 6.55 (-5.9 bp)

2.89Y 18巢湖城鎮MTN002 AA/AA 6.71 (0 bp)

3.81Y 17樂山國資MTN001 AA/AA 5.65 (-7.6 bp)

2.2Y+2Y 18新都興城MTN001 AA/AA 6.85 行權

2.48Y+2Y 18洪山城投MTN001 AA/AA 5.3 行權

5、(高宇)今日存單一級計劃發行約840億元,進入月末銀行報價明顯減少,AAA城商行1Y 3.65%附近成為市場主力,其餘品種價格變動不大表現一般;二級存單成交活躍,國股1M成交在2.30%附近,3M成交在3.05%附近,6M成交在3.35%附近,9M成交在3.55%附近,1Y成交在3.55%附近。

6D 18浙商銀行CD034 AAA/0 2.35 (-5.9 bp)

6D 18南京銀行CD014 AAA/0 2.35 (-5.9 bp)

6D 18浙商銀行CD034 AAA/0 2.4 (-0.9 bp)

8D 18招商銀行CD041 AAA/0 2.35 (-2.3 bp)

8D 17江蘇銀行CD306 AAA/0 2.37 (-5.3 bp)

9D 18寧波銀行CD185 AAA/0 2.37 (-5.6 bp)

9D 18廈門國際銀行CD084 AAA/0 2.4 (-2.5 bp)

11D(休2) 18中信銀行CD133 AAA/0 2.55 (17.1 bp)

11D(休2) 18上海銀行CD311 AAA/0 2.5 (12.1 bp)

11D(休2) 17北京銀行CD251 AAA/0 2.7 (32.1 bp)

17D 18蘇州銀行CD106 AAA/0 2.45 (-6.9 bp)

17D 18蘇州銀行CD106 AAA/0 2.45 (-6.9 bp)

22D 17錦州銀行CD354 AAA/0 2.45 (-20 bp)

24D 17重慶銀行CD181 AAA/0 2.36 (-10.6 bp)

28D 18中國銀行CD034 AAA/0 2.31 (-8.6 bp)

28D 18鄭州銀行CD027 AAA/0 2.4 (-9.6 bp)

29D 18寧波銀行CD043 AAA/0 2.48 (-1.9 bp)

30D 18平安銀行CD140 AAA/0 2.35 (-10 bp)

31D 18建設銀行CD188 AAA/0 2.3 (-10 bp)

56D 18民生銀行CD487 AAA/0 2.4 (-5 bp)

56D 18民生銀行CD487 AAA/0 2.4 (-5 bp)

56D 18農業銀行CD165 AAA/0 2.3 (-10.4 bp)

58D 17杭州銀行CD266 AAA/0 2.48 (-2.5 bp)

74D(休2) 18交通銀行CD013 AAA/0 3.05 (2 bp)

74D(休2) 18交通銀行CD013 AAA/0 3.05 (2 bp)

77D 18寧波銀行CD197 AAA/0 3.05 (-7.1 bp)

77D 18上海銀行CD320 AAA/0 3 (-7.1 bp)

82D 18興業銀行CD188 AAA/0 3.05 (-5.2 bp)

88D(休2) 18廈門國際銀行CD169 AAA/0 3.17 (-1.2 bp)

121D 18農業銀行CD139 AAA/0 3.15 (3.2 bp)

121D 18農業銀行CD139 AAA/0 3.15 (3.2 bp)

121D 18農業銀行CD148 AAA/0 3.15 (3.2 bp)

125D 18恒豐銀行CD365 AAA/0 3.35 (0.4 bp)

138D 18農業銀行CD156 AAA/0 3.18 (2.6 bp)

142D 18農業銀行CD163 AAA/0 3.18 (1.8 bp)

148D 18交通銀行CD216 AAA/0 3.18 (-4.5 bp)

164D 18渤海銀行CD235 AAA/0 3.4 (7 bp)

170D 18招商銀行CD193 AAA/0 3.28 (0.7 bp)

178D 18交通銀行CD237 AAA/0 3.25 (-3.9 bp)

205D 18貴陽銀行CD085 AAA/0 3.48 (-0.3 bp)

240D 18興業銀行CD464 AAA/0 3.5 (-0.3 bp)

258D 18招商銀行CD188 AAA/0 3.55 (-0.7 bp)

258D 18華夏銀行CD289 AAA/0 3.55 (-0.7 bp)

260D 18杭州銀行CD056 AAA/0 3.58 (-4.3 bp)

260D 18華夏銀行CD295 AAA/0 3.55 (-1.1 bp)

266D 18浦發銀行CD224 AAA/0 3.555 (-1.5 bp)

268D 18浦發銀行CD340 AAA/0 3.55 (-2.3 bp)

268D 18交通銀行CD234 AAA/0 3.53 (-4.3 bp)

269D 18華夏銀行CD315 AAA/0 3.55 (-2.4 bp)

269D 18交通銀行CD238 AAA/0 3.54 (-3.4 bp)

269D 18浦發銀行CD344 AAA/0 3.55 (-2.4 bp)

269D 18平安銀行CD304 AAA/0 3.55 (-2.4 bp)

269D 18交通銀行CD238 AAA/0 3.54 (-3.4 bp)

269D 18平安銀行CD304 AAA/0 3.55 (-2.4 bp)

269D 18華夏銀行CD314 AAA/0 3.55 (-2.4 bp)

269D 18華夏銀行CD315 AAA/0 3.55 (-2.4 bp)

269D 18興業銀行CD508 AAA/0 3.55 (-2.4 bp)

269D 18浦發銀行CD344 AAA/0 3.55 (-2.4 bp)

269D 18華夏銀行CD315 AAA/0 3.55 (-2.4 bp)

273D 18民生銀行CD565 AAA/0 3.555 (355.5 bp)

273D 18平安銀行CD305 AAA/0 3.55 (355 bp)

273D 18平安銀行CD305 AAA/0 3.55 (355 bp)

273D 18平安銀行CD305 AAA/0 3.55 (355 bp)

273D 18光大銀行CD175 AAA/0 3.55 (-2.5 bp)

275D 18興業銀行CD369 AAA/0 3.55 (-2.6 bp)

275D 18哈爾濱銀行CD125 AAA/0 3.74 (-0.8 bp)

281D 18東莞農村商業銀行CD071 AAA/0 3.7 (-0.4 bp)

283D 18長沙銀行CD146 AAA/0 3.6 (-5.6 bp)

283D 18上海銀行CD252 AAA/0 3.57 (-0.7 bp)

290D 18成都銀行CD207 AAA/0 3.6 (-11.1 bp)

290D 18長沙銀行CD151 AAA/0 3.6 (-6.1 bp)

319D(休2) 18江西銀行CD096 AAA/0 3.7 (-7.4 bp)

326D(休2) 18民生銀行CD486 AAA/0 3.6 (2 bp)

330D 18浦發銀行CD283 AAA/0 3.55 (-3 bp)

346D 18北京銀行CD200 AAA/0 3.6 (2 bp)

360D 18交通銀行CD235 AAA/0 3.55 (-3 bp)

360D 18交通銀行CD235 AAA/0 3.55 (-3 bp)

8D 17吉林銀行CD186 AA+/0 2.55 (7.8 bp)

8D 18烏魯木齊銀行CD055 AA+/0 2.43 (-9.2 bp)

29D 18晉商銀行CD047 AA+/0 2.6 (-1.9 bp)

56D 18昆山農村商行CD013 AA+/0 2.6 (-17.7 bp)

57D 18廣東華興銀行CD055 AA+/0 2.6 (-7.4 bp)

57D 18包商銀行CD071 AA+/0 3.5 (79.6 bp)

120D 18東莞銀行CD102 AA+/0 3.32 (-4.1 bp)

206D 18西安銀行CD032 AA+/0 3.55 (-3.2 bp)

6、(閆宜乘)資金面延續非常寬鬆,信用債交投活躍度非常高,高評級放量成交,市場情緒高漲,5年以上鐵道,匯金等成交多筆,小幅減點成交,1-5年高等級信用債成交普遍減點5個bp左右,中低評級活躍度一般,純AA仍然以老城投為主。

10D 11鐵道05 AAA/AAA 2.45 (6 bp)

80D 18光證01 AAA/0 3.8 (4.7 bp)

120D 17銀河F1 AAA/AAA 3.95 (8.8 bp)

125D 16財通債 AAA/AAA 3.58 (-16.1 bp)

138D(休1) 16兩江01 AAA/AAA 3.73 (7.1 bp)

139D 16北京銀行01 AAA/AAA 3.3 (9.3 bp)

212D 12蘇園建債 AAA/AAA 3.75 (3.2 bp)

250D(休1) 16兩江02 AAA/AAA 3.83 (2.9 bp)

264D+NY(休1) 16葛洲Y1 AAA/AAA 4.23 (-2.6 bp)

273D 09長電債 AAA/AAA 3.55 (-4.9 bp)

309D 12蓉投控 AAA/AAA 3.85 (-1.2 bp)

324D 16華潤02 AAA/AAA 3.73 (0.4 bp)

327D(休1) 09鐵道01 AAA/AAA 3.52 (-5.7 bp)(大量成交)

352D 14中電財務02 AAA/AAA 3.82 (-8 bp)

1.03Y 12華新03 AAA/AAA 4.2 (-4.3 bp)

1.04Y 16國網01 AAA/AAA 3.68 (7.1 bp)

1.07Y 16兗礦PPN001B AAA/0 4.68 (0.3 bp)

1.08Y 16新燃01 AAA/AAA 3.97 (-0.9 bp)

1.09Y 14中國華融債02 AAA/AAA 3.76 (7.5 bp)

1.12Y 16國電資 AAA/AAA 3.74 (-2.3 bp)

1.44Y 10湘高速 AAA/AAA 3.95 (1.5 bp)

1.45Y 17國信01 AAA/AAA 3.82 (-1.2 bp)

0.47Y+1Y 17兵裝01 AAA/AAA 3.5行權 (-22.2 bp)

1.48Y 17桂鐵02 AAA/AAA 4.45 (-4.2 bp)

1.62Y 17東興02 AAA/AAA 3.81 (-6.8 bp)

0.66Y+1Y 17中證02 AAA/0 4.59行權 (-38.3 bp)

0.7Y+1Y 17金隅03 AAA/AAA 4.5行權 (-22 bp)

1.76Y 17國君G1 AAA/AAA 3.78 (-3.1 bp)

1.78Y 17海通01 AAA/AAA 3.81 (-0.6 bp)

1.8Y 15遠洋01 AAA/AAA 4.2 (-4.8 bp)

1.83Y 15齊魯債 AAA/AAA 3.9 (-3.4 bp)

1.95Y PR錫城發 AAA/AAA 4.2 (14.3 bp)

2Y 10鐵道07 AAA/AAA 3.82 (-3.7 bp)

2.08Y 17中信G4 AAA/AAA 3.85 (-4.5 bp)

0.14Y+2Y 15新燃01 AAA/AAA 3.1行權 (-112.5 bp)

0.20Y+2Y 16富力01 AAA/AAA 4.12 (-280.5 bp)

0.21Y+2Y 16中糧01 AAA/AAA 3.28行權 (-85.8 bp)

0.21Y+2Y 16保利01 AAA/AAA 3.4行權 (-71.9 bp)

2.34Y 16外運01 AAA/AAA 4.03 (-0.9 bp)

2.36Y 16廈貿01 AAA/AAA 4.27 (12.8 bp)

2.37Y 16首開01 AAA/AAA 4.05 (5.5 bp)

2.37Y 16珠江01 AAA/AAA 4.3 (0.5 bp)

0.39Y+2Y 16遠東三 AAA/AAA 3.92行權 (3 bp)

2.39Y 18海通02 AAA/AAA 3.9 (-4.5 bp)

2.39Y 11皖投債 AAA/AAA 4.06 (-3.5 bp)

2.4Y 16廣電01 AAA/AAA 4 (-4.8 bp)

2.4Y+NY 18兗煤Y1 AAA/AAA 4.98 (6.2 bp)

2.45Y 18BMW汽車01 AAA/AAA 4.23 (-4.5 bp)

2.47Y 18光證G2 AAA/AAA 3.89 (-6.7 bp)

2.47Y 06太空債 AAA/AAA 3.96 (0.7 bp)

2.49Y 18廣發01 AAA/AAA 3.9 (-5.6 bp)(大量成交)

2.55Y 18電投02 AAA/AAA 3.98 (1.8 bp)

2.56Y 18電投03 AAA/AAA 3.98 (1.8 bp)

2.56Y 18福特汽車02 AAA/AAA 4.22 (3 bp)

0.56Y+2Y 16萬達03 AAA/AAA 5.15行權 (-92.7 bp)

2.62Y 18蛇口04 AAA/AAA 4.04 (-3.7 bp)(大量成交)

2.62Y 18中證G1 AAA/AAA 3.92 (-4.9 bp)

2.68Y 16廣電02 AAA/AAA 4.03 (-5.5 bp)

2.70Y 18國電03 AAA/AAA 3.97 (-0.5 bp)

2.73Y 18BMW汽車02 AAA/AAA 4.25 (-6.1 bp)

2.76Y 18紫光03 AAA/AAA 5.7 (-3.7 bp)

2.77Y 18海通04 AAA/AAA 3.9 (-8.2 bp)

2.77Y 18招商G6 AAA/AAA 3.9 (-9.7 bp)

0.78Y+2Y 16電投04 AAA/AAA 3.7行權 (-28.4 bp)

2.8Y 18國信三 AAA/AAA 4.02 (-2.4 bp)

2.83Y 18浙商銀行01 AAA/AAA 3.98 (-8 bp)

2.84Y 18電投05 AAA/AAA 3.98 (-0.9 bp)

2.86Y 18電投06 AAA/AAA 3.98 (-1.1 bp)

2.89Y 18電投07 AAA/AAA 3.98 (-1.5 bp)

0.89Y+2Y 16福新01 AAA/AAA 3.85 (-36.3 bp)

0.9Y+2Y 16石化01 AAA/AAA 3.66行權 (-29.1 bp)

2.97Y G16國網2 AAA/AAA 3.91 (-4.9 bp)

0.99Y+2Y 16中燃G1 AAA/AAA 3.85 (-27.7 bp)

1.03Y+2Y 16滇路02 AAA/AAA 4.38行權 (-40.7 bp)

1.22Y+2Y 17中材01 AAA/AAA 3.8行權 (-39.1 bp)

0.22Y+3Y 17同煤01 AAA/0 5.3行權 (-90.2 bp)

1.29Y+2Y 17遠東一 AAA/0 5.3行權 (-3 bp)

0.35Y+3Y 16龍湖03 AAA/AAA 3.95行權 (-98.5 bp)

3.40Y 17鐵道02 AAA/AAA 3.92 (0.6 bp)(大量成交)

1.55Y+2Y 17金隅01 AAA/AAA 3.91行權 (-47.3 bp)

3.7Y 17鐵道12 AAA/AAA 3.92 (-2.6 bp)

1.75Y+2Y 17京資01 AAA/AAA 3.83行權 (-24.7 bp)

1.8Y+2Y 15遠洋02 AAA/AAA 4.2行權 (-45.9 bp)

1.81Y+2Y 17國投01 AAA/AAA 3.84行權 (-25.5 bp)

1.98Y+2Y 15贛粵02 AAA/AAA 3.88行權 (-28 bp)

1.07Y+3Y 16光控03 AAA/AAA 3.78 (-55.8 bp)

4.08Y 17鐵道18 AAA/AAA 3.96 (-2.5 bp)(大量成交)

2.21Y+2Y 16保利02 AAA/AAA 4.02行權 (-34.5 bp)(大量成交)

4.39Y 18吉高02 AAA/AAA 5.25 (-15.4 bp)

2.39Y+2Y 16越交02 AAA/AAA 4.19行權 (14.3 bp)

2.47Y+2Y 18中化01 AAA/AAA 4.03行權 (-38 bp)

2.47Y+2Y 18穗發01 AAA/AAA 4.05 (-36 bp)

4.48Y 18滬國01 AAA/AAA 4.28 (-3.2 bp)

2.48Y+2Y 18圓融01 AAA/AAA 4.05行權 (-49.3 bp)

4.49Y 18浙能01 AAA/AAA 4.25 (0.8 bp)

2.52Y+2Y 18中煤01 AAA/AAA 4.09行權 (-42.4 bp)

2.64Y+2Y 18齊魯01 AAA/AAA 4.1行權 (-21.1 bp)

4.72Y+N 18華電Y2 AAA/AAA 4.77 (-6.6 bp)

4.73Y 18廣開01 AAA/AAA 4.57 (-27.1 bp)

2.87Y+2Y 18中燃01 AAA/AAA 4.2行權 (-27.8 bp)

4.87Y 18匯金01 AAA/0 4.08 (0.9 bp)

2.90Y+2Y 16港務01 AAA/AAA 4.05行權 (-0.7 bp)

2.99Y+2Y 16中金04 AAA/AAA 3.9行權 (-7.7 bp)

3.05Y+2Y 16港務02 AAA/AAA 4.13行權 (5.3 bp)

5.45Y 14鐵道01 AAA/AAA 4.16 (8.7 bp)

1.79Y+5Y 15信投01 AAA/AAA 3.8行權 (-2.3 bp)

1.81Y+5Y 15金街02 AAA/AAA 4.025行權 (-79.2 bp)

7.06Y 15五礦04 AAA/AAA 5.23 (-3.1 bp)

2.5Y+5Y 11深發展01 AAA/AA+ 4.7行權 (16.1 bp)

8.62Y 17鐵道11 AAA/AAA 4.24 (-2.2 bp)

8.74Y 17鐵道15 AAA/AAA 4.24 (-2.3 bp)

9.12Y 17鐵道21 AAA/AAA 4.245 (-2 bp)

9.45Y 18鐵道10 AAA/AAA 4.24 (-2.6 bp)

4.78Y+5Y 18京投01 AAA/AAA 4.32行權 (-50.6 bp)

17.96Y 16鐵道06 AAA/AAA 4.38 (-3.5 bp)

34D 15開元02 AA+/AA+ 3.5 (11.4 bp)

141D PR宣國投 AA+/AAA 4.55 (15.6 bp)

283D 16吳發02 AA+/0 4.95 (-2 bp)

287D 12中儲債 AA+/AAA 4.27 (-5.1 bp)

1.37Y 17太證C1 AA+/AA 5.5 (41.3 bp)

1.38Y PR餘創債 AA+/AA+ 4 (-1.3 bp)

1.41Y 15湘財02 AA+/0 5.5 (39.9 bp)

1.88Y 15常城01 AA+/0 5.5 (45.8 bp)

1.88Y 15常城02 AA+/0 5.5 (45.8 bp)

1.96Y 15廈住宅 AA+/AA+ 4.5 (12.5 bp)

2.22Y 16廣新01 AA+/AA+ 4.7 (-8.9 bp)

0.22Y+2Y 16涪陵01 AA+/AA+ 3.67行權 (-68.8 bp)

0.24Y+2Y 16國汽01 AA+/AA+ 3.85行權 (-69.3 bp)

0.33Y+2Y 16中牧01 AA+/AA+ 4行權 (-35.7 bp)(大量成交)

2.34Y 13黃岡城投債02 AA+/AAA 4.27 (-10.9 bp)

0.35Y+2Y 16建元01 AA+/AA+ 4.3行權 (-90.9 bp)

0.67Y+2Y 16新興01 AA+/AA+ 4.2 (-63.3 bp)

2.68Y 16廣新03 AA+/AA+ 4.73 (-10.4 bp)

0.71Y+2Y 16魯宏02 AA+/0 6.4行權 (-107.6 bp)

2.77Y 14虞城建債 AA+/AA+ 4.86 (-5.2 bp)

2.85Y 16海投債 AA+/AA+ 5.2 (-9.4 bp)

0.87Y+2Y 16諸資01 AA+/0 4.88行權 (-37.2 bp)

0.91Y+2Y 16康恩貝 AA+/AA+ 5行權 (-74.8 bp)

0.95Y+2Y 16大華02 AA+/AA+ 5.9行權 (66.1 bp)

1.58Y+2Y 15建發債 AA+/AAA 4.25行權 (-37.3 bp)

1.62Y+2Y 17浦土01 AA+/AAA 3.97行權 (-31.7 bp)

0.73Y+3Y 17康富01 AA+/0 7.1行權 (-51.8 bp)

1.12Y+3Y 12桂交投債 AA+/AA+ 5.15到期 (1.9 bp)

2.41Y+2Y G18華綜1 AA+/AAA 4.28 (-45.4 bp)

4.49Y 16溫城專項債02 AA+/AA+ 4.66 (2.3 bp)

2.56Y+2Y 18岸資01 AA+/AA+ 5.08行權 (-59.9 bp)

84D 16搜候債 AA/AAA 5.02 (4.4 bp)

122D 16丹陽02 AA/0 8 (69.2 bp)

172D 12十堰城投債 AA/AA 4.45 (3.8 bp)

190D 12平發投債 AA/AA 4.9 (-2.6 bp)

210D 12惠投債 AA/AA 4.57 (-2.4 bp)

353D 12韶關債 AA/AA 4.48 (-8 bp)

1.11Y 12渝興債 AA/AA 4.7 (-1.6 bp)

1.12Y PR新城投 AA/AA 5 (38.2 bp)

0.99Y+1Y 17光線01 AA/AAA 5行權 (-2.3 bp)

0.35Y+2Y 16興發01 AA/AA 5.2行權 (28.4 bp)

2.65Y PR孝高01 AA/AA 5.5 (7.9 bp)

1.03Y+2Y 17騰越02 AA/AAA 7.2行權 (23.7 bp)

3.5Y 15紹新城債 AA/AA 5.22 (-0.1 bp)

4.38Y 16啟交通 AA/AAA 5.3 (67.5 bp)

5.50Y 17威高新 AA/AAA 4.9 (5.3 bp)

0.74Y+5Y 14陜交建債 AA/AA 3.78行權 (-115.9 bp)

7、(朱琳)今日交易所成交清淡,中低等級及民企偏多,不乏高收益成交,剩餘期限集中在2-3Y期不變,收益率漲跌不一。

代碼

名稱

136160.SH

16東旭01

2.2192

6078.3

-21.45

9.782

AA+

136223.SH

16卓越01

2.3233

5000

14.28

5.9499

AA

1.8247

4587.3

-11.89

6.0574

AAA

136135.SH

16聯泰01

3.1863

4208

0.04

6.0899

AA+

143835.SH

18奧園04

2.9507

4000

3.94

8.5599

AA+

3.6877

3909.5

-0.65

6.7067

AAA

3.2438

3807.4

-60.33

13.279

AAA

136092.SH

15連雲港

2.1123

3000

-18.82

5.6838

AA

143636.SH

18國聯G1

4.5233

3000

21.32

4.7392

AAA

1.8795

2700

-0.04

7.9182

AA

122330.SH

13中企債

0.9562

2200

-0.46

3.9679

AA

122431.SH

15閩高速

1.7808

2100.8

-3.06

3.9872

AA+

143646.SH

18中租一

2.8932

2070

-20.19

7.3338

AAA

122329.SH

14伊泰01

0.9425

2016.6

1.34

4.3018

AAA

136434.SH

16葛洲03

2.5342

2000

-36.35

4.0097

AAA

143637.SH

18日照01

4.526

2000

0

5.3673

AA+

136246.SH

16津投01

7.3342

1950

0.98

3.7532

AAA

136143.SH

16萬達01

2.2082

1948.4

-4.75

3.2299

AAA

136095.SH

15錫交01

2.1288

1800.4

-20.2

4.4227

AA+

136058.SH

15宜集債

2.074

1766

11.1

7.8032

AA+

136329.SH

16國美03

3.526

1684

0.05

5.1858

AA+

136099.SH

15紹交01

2.126

1600

6.37

5.171

AA+

122433.SH

15融創02

1.789

1574.9

4.08

10.5064

AA+

136458.SH

16聖牧01

2.5863

1500.3

36.55

21.1821

AA

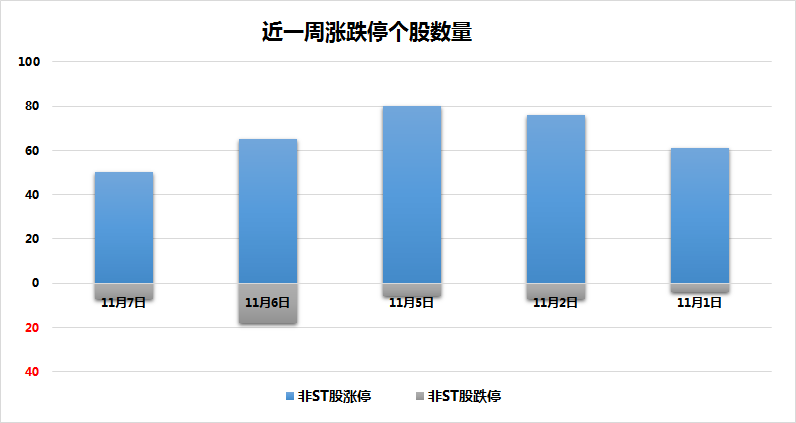

8、(吳昊)A股今日沖高回落,兩市成交超3100億,北上資金連續兩日淨流入,消息面上,中國平安三季度業績不及預期,但拋出千億回購議案提振市場情緒,今日早盤市場情緒明顯緩和,白馬股普遍開始反彈,發改委提議汽車購置稅減半,行業上看,券商板塊再掀漲停潮,非銀板塊漲幅達3%,銀行,汽車和地產同樣表現出色,板塊漲幅均在1.5%以上,下跌方面,白酒股仍在下跌,茅台全天寬幅震蕩,早盤低開,午後一度接近翻紅,尾盤回落,收跌接近5%,成交突破百億創歷史記錄。茅台走弱拖累食品飲料板塊繼續走跌,板塊跌幅超1%,此外,通信和農林板塊小幅下跌。截至收盤,上證指數漲1.02%,收2568.05,深證成指漲0.72%,收7375.23,創業板指漲0.76%,收1259.95。

轉債漲跌各半,金融轉債偏強,吳銀,江銀漲幅超1%,康泰漲1.6%居首,利歐連續三日大漲,今日漲幅1.5%,小康跌1.9%,海瀾,雙環,道氏,隆基跌幅超1%,其餘個券小幅波動為主。